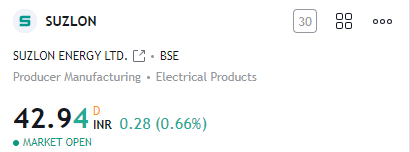

Suzlon Share Price Analysis and Investment, a prominent player in the renewable energy sector, has not only been a leader in sustainable solutions but also a subject of interest for investors keen on understanding the dynamics of its share price.

Suzlon Share Price Analysis and Investment

Table of Contents

II. Historical Context

A. Suzlon’s Journey in the Market

Suzlon’s inception and growth have been noteworthy, carving a niche in the renewable energy industry. Exploring its historical performance sets the stage for a comprehensive analysis.

III. Factors Influencing Share Price

A. Market Trends

Understanding the broader market trends helps decipher Suzlon’s share price movements. Analyzing the correlation between market dynamics and Suzlon’s stock performance provides valuable insights.

B. Industry Developments

The renewable energy sector is dynamic, with policy changes and technological advancements impacting companies. Examining how industry shifts affect Suzlon’s share price is crucial.Suzlon Share Price Analysis and Investment

read thisMotisons Jewellers Share Price: Unraveling the Dynamics of a Market Gem1

IV. Suzlon’s Financial Performance

A. Revenue Analysis

Delving into Suzlon’s financials, a detailed analysis of revenue trends unveils the company’s financial health. How revenue streams contribute to share price becomes evident.Suzlon Share Price Analysis and Investment

B. Profitability Metrics

Beyond revenue, profitability metrics such as net income and margins provide a holistic view. Investors keen on long-term gains analyze these factors meticulously.

V. Recent News and Events

A. Impact on Share Price

Suzlon, like any publicly traded company, is affected by current events. Investigating the correlation between recent news and share price fluctuations is essential.Suzlon Share Price Analysis and Investment

VI. Investor Sentiment

A. Analyzing Market Sentiment

Investor sentiment plays a pivotal role in share price movements. Examining how positive or negative sentiment influences Suzlon’s stock offers valuable insights.Suzlon Share Price Analysis and Investment

VII. Expert Opinions

A. Analysts’ Insights

Expert opinions from financial analysts can shape investor decisions. Analyzing what experts say about Suzlon’s future can guide potential investors.Suzlon Share Price Analysis and Investment

VIII. Future Projections

A. Growth Prospects

Looking ahead, understanding Suzlon’s growth prospects is crucial for investors. Examining expansion plans and new projects provides a glimpse into the company’s future.

IX. Risks and Challenges

A. Potential Hindrances

Identifying risks and challenges Suzlon faces is imperative. Whether regulatory changes or industry-specific issues, assessing potential hindrances is vital.

X. Comparative Analysis

A. Suzlon vs. Competitors

Benchmarking Suzlon against industry competitors reveals its competitive positioning. Investors evaluating alternatives benefit from this comparative analysis.

XI. Key Takeaways

A. Summarizing Key Points

Condensing crucial information into key takeaways offers readers a quick overview of Suzlon’s share price dynamics and the factors influencing them.

XII. Investing in Suzlon

A. Considerations for Investors

For potential investors, understanding what factors to consider before investing in Suzlon is paramount. Risk tolerance, investment horizon, and financial goals play pivotal roles.

XIII. Tips for Shareholders

A. Maximizing Returns

Existing shareholders seeking to optimize their returns can explore strategies and tips tailored to Suzlon’s unique market dynamics.

XIV. Community Impact

A. Corporate Social Responsibility

Beyond financials, Suzlon’s impact on communities through corporate social responsibility initiatives provides a holistic perspective.

XV. Conclusion

A. Final Thoughts

In conclusion, Suzlon’s share price reflects a confluence of internal and external factors. Investors navigating this dynamic market should consider a comprehensive approach.

Is Suzlon a good investment in the current market scenario?

Answer: Investment decisions depend on various factors, including individual risk tolerance and market conditions. It’s advisable to conduct thorough research or consult a financial advisor

How do recent industry developments impact Suzlon’s share price?

Answer: Industry shifts can influence Suzlon’s share price, with advancements or policy changes playing a role. Staying updated on these developments is crucial.

What are the key financial metrics to analyze when considering Suzlon for investment?

Answer: Revenue trends, profitability metrics, and growth prospects are essential financial metrics to evaluate Suzlon’s investment potential.

How does Suzlon contribute to renewable energy and sustainability?

Answer: Suzlon contributes to renewable energy through its wind energy solutions, promoting sustainable practices in the energy sector.

What are the potential risks associated with investing in Suzlon?

Answer: Risks may include regulatory changes, market volatility, and industry-specific challenges. Understanding these risks is crucial for informed investment decisions.